Follow the process to appeals (if applicable).Īppealing an amended return works a lot like audit appeals, where you state your facts and legal argument to support your position. But because this process is more informal, the IRS often allows appeals after the 30-day deadline. You should file the petition within 30 days of the denial letter. For higher amounts, create your own petition that includes the facts, law, argument, and your position.For amounts less than $25,000, use IRS Form 12203.

If you disagree with the IRS, you’ll need to start by filing a petition about your rejected tax return with the IRS Office of Appeals. For example, if the IRS has denied your amended return because of a past audit, you might need to ask for audit reconsideration to try to reverse the audit results. You might have other issues that you need to address. If it’s more complicated, like a formal denial (usually with IRS letter 105C or 106C), you might consider appealing your case. If the IRS rejected the amended tax return because of a procedural error (usually with IRS letter 916C), it might be as simple as refiling the amended return, providing proof of an item on your return, or filing an additional form.

But if you think the IRS unfairly rejected your tax return, you might have several options. If you think the IRS denial is correct, you don’t have to do anything else.

Understand your options and take the next step. Interpreting transcripts can be difficult, so you might want to consult a tax expert. But the transcript might help you piece together the details to better understand the point of view of the IRS or what the IRS did wrong. For example, your transcript won’t tell you exactly why the IRS made changes to a filed return, or why the IRS rejected your amended return. IRS transcripts don’t show all the activity on your IRS account, so you might have to ask more questions. You might need to request your IRS transcripts to get more details.

#NUMBER FOR TURBOTAX PRO#

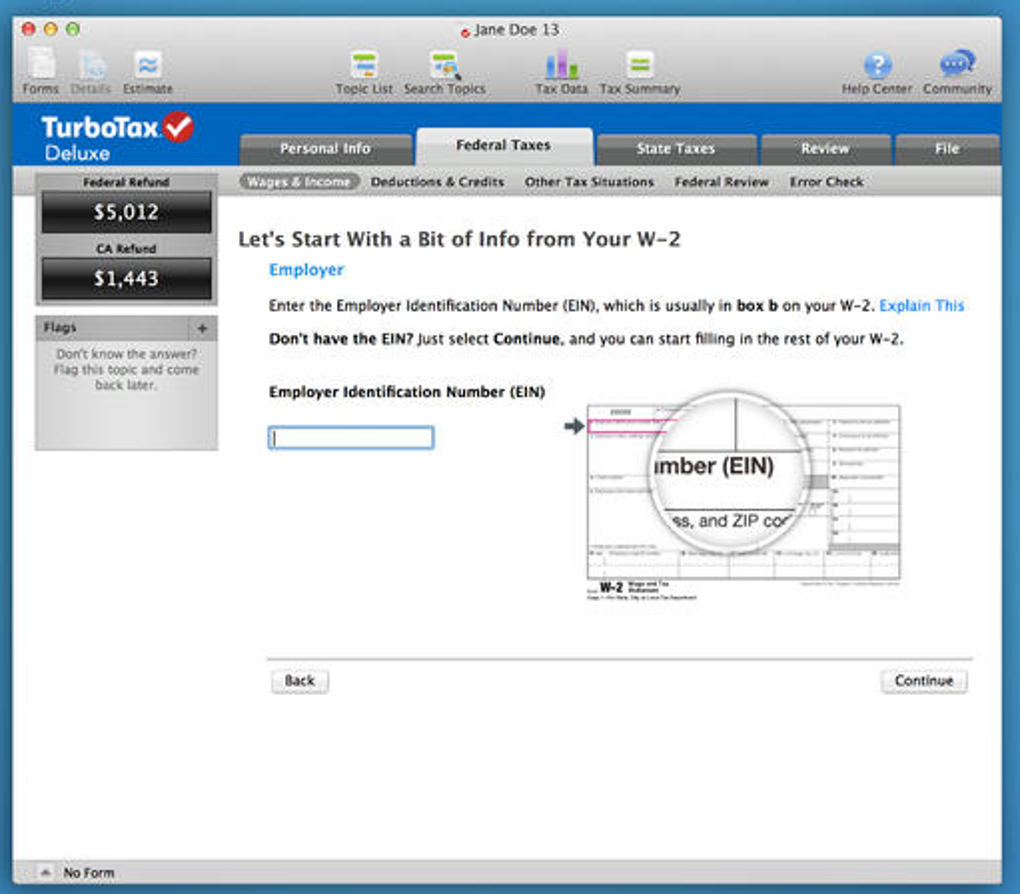

A tax pro can help you navigate this step. Understanding why your tax return was rejected is easier if you know how the IRS talks about the details of your account. Start with the phone number listed on your last notice. Many times, you’ll need to directly contact the IRS. Understand and investigate why the IRS rejected your amended return. What do you do now? While the process of figuring what went wrong isn’t always easy, it boils down to a few simple steps. Sign in to your account.You’ve gone to all the trouble of amending your return, only to have the IRS reject your amended tax return.If you downloaded TurboTax through TurboTax Advantage, you can find your license code:

#NUMBER FOR TURBOTAX INSTALL#

Return to the install screen and enter the code to continue.Select Downloads and look for your license code under the TurboTax product name.

#NUMBER FOR TURBOTAX SOFTWARE LICENSE#

Make sure it's the same one you used to purchase the software license

0 kommentar(er)

0 kommentar(er)